What is the financial standing of this individual? A comprehensive overview of their assets and wealth.

Estimating an individual's financial worth, often referred to as net worth, involves calculating the difference between total assets and total liabilities. Assets encompass various holdings, such as real estate, investments, and personal possessions. Liabilities represent debts and outstanding obligations. This calculation provides a snapshot of an individual's current financial position.

Understanding an individual's net worth can be crucial for various reasons. For businesses, it may offer insights into the financial health and stability of a potential partner or client. In a broader context, public knowledge of a person's wealth can influence public perception and potentially impact investment decisions and market trends. Moreover, a person's net worth might serve as a reflection of their achievements and life's journey.

Read also:Maya Shetty Rohit Shetty A Starstudded Connection

| Category | Details |

|---|---|

| Name | (Replace with actual name) |

| Date of Birth | (Replace with actual date) |

| Occupation | (Replace with actual occupation) |

| Source of Wealth | (Placeholder - Replace with details, if available.) |

Further exploration into this individual's financial details would require specific data. In order to offer a truly insightful analysis, details regarding sources of income, investment strategies, and asset valuation would be essential. This article serves as an introduction to the concept of net worth, demonstrating how such information can be used and interpreted.

Holyten Net Worth

Understanding Holyten's net worth involves examining various contributing factors. This analysis requires careful consideration of financial data and its implications.

- Assets

- Liabilities

- Income Sources

- Investment Strategies

- Valuation Methods

- Public Perception

- Market Trends

- Financial History

These aspects collectively paint a picture of Holyten's financial standing. For example, substantial assets, coupled with prudent investment strategies, often correlate with a high net worth. Conversely, significant liabilities can diminish a person's financial position. Public perception of an individual's success can influence market trends and investment decisions related to their business or holdings. Analyzing historical financial data can provide insights into the growth trajectory and stability of the overall financial picture, indicating potential strengths and weaknesses. Understanding the individual's income streams reveals the mechanisms driving wealth accumulation or decline. Accurate valuation methods are critical for assessing the worth of assets, which is crucial to any precise net worth calculation. In summary, a comprehensive understanding of "Holyten net worth" necessitates a detailed examination of all these interconnected elements.

1. Assets

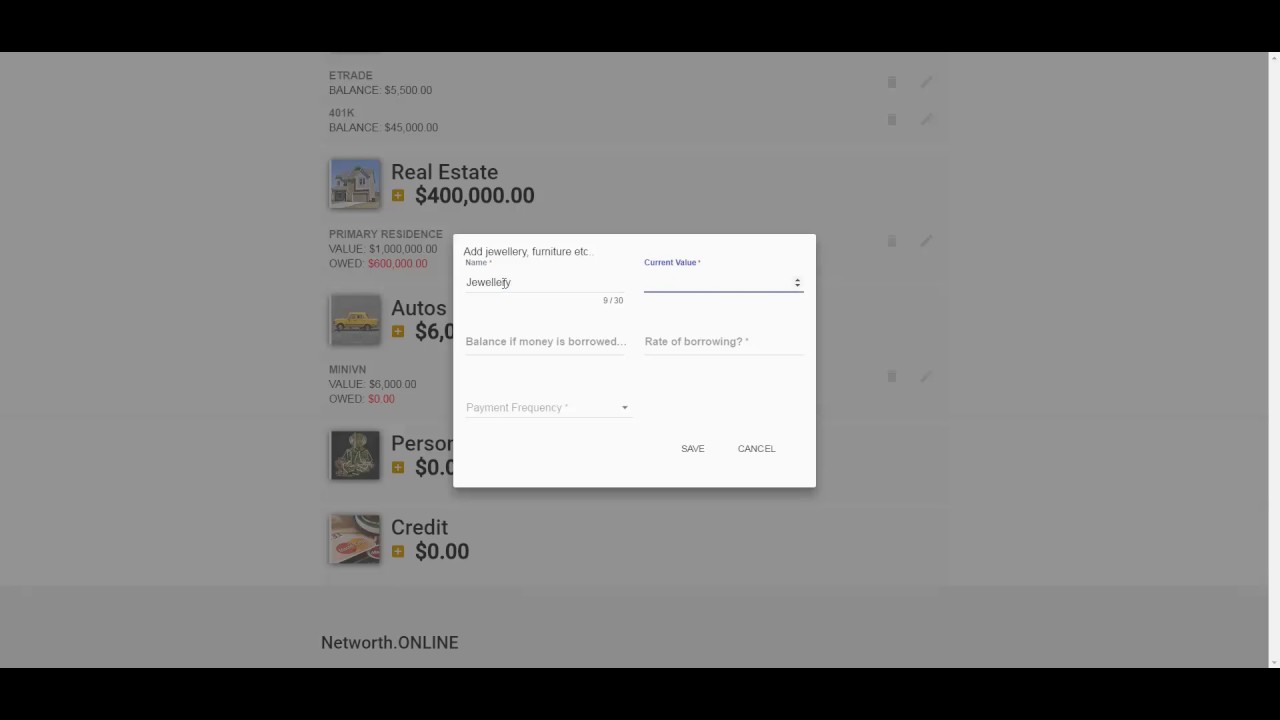

Assets are the cornerstone of an individual's net worth. They represent the sum total of valuable possessions, including but not limited to real estate, investments, and personal property. The value of these assets directly impacts the calculation of net worth. A substantial increase in the value of assets generally leads to a corresponding rise in net worth, while a decline in asset values has the opposite effect. For example, a significant real estate portfolio or successful investments in the stock market contribute meaningfully to a higher net worth. Conversely, a substantial loss in the value of a major asset can significantly reduce net worth.

The significance of assets in determining net worth extends beyond mere numerical calculations. The type and diversification of assets held offer insights into an individual's investment strategies and risk tolerance. Liquid assets, such as cash and easily convertible investments, provide financial flexibility, while illiquid assets, such as real estate, may represent long-term commitments and require different considerations for valuation. The presence of valuable assets can indicate financial success and the ability to generate income, often attracting opportunities and influencing decisions. Assessing the quality and nature of assets is crucial for a comprehensive understanding of an individual's financial standing.

In conclusion, assets are a primary determinant of net worth. Understanding the composition, value, and diversification of these assets provides critical context in evaluating financial standing. Fluctuations in asset values directly impact net worth, highlighting the interconnectedness of these elements. The type and character of assets held provide insight into financial strategies and risk tolerance, ultimately contributing to the complete picture of an individual's financial position.

Read also:Sone 436 Video Ultimate Guide Tutorials

2. Liabilities

Liabilities, representing financial obligations, hold a crucial, though often overlooked, connection to an individual's net worth. They represent debts and outstanding payments that must be settled. A precise understanding of liabilities is essential for determining true financial standing. Higher levels of liabilities often counteract the positive impact of assets, ultimately reducing net worth. For example, substantial loans, outstanding credit card balances, or significant tax obligations directly diminish the net worth figure. Conversely, a reduction in liabilities strengthens the overall financial position and contributes to a higher net worth. This principle is fundamental to evaluating the financial health and stability of any individual.

The interplay between liabilities and net worth is not merely mathematical. The types and amounts of liabilities provide insights into financial strategies and choices. Heavily indebted individuals may be operating under pressure, potentially limiting investment opportunities or flexibility in financial decision-making. Conversely, individuals with well-managed liabilities typically enjoy greater financial freedom, potentially leading to more robust investment strategies and wealth accumulation. A careful examination of liabilities reveals important information about an individual's financial conduct and current standing, aiding in comprehensive evaluations of their financial position. A balanced consideration of liabilities alongside assets is indispensable in obtaining a complete understanding of an individual's financial health.

In summary, liabilities directly impact net worth, functioning as a counterpoint to assets. Their types and magnitudes offer clues about financial strategies and current pressures. Understanding the relationship between liabilities and net worth is critical for a comprehensive evaluation of financial health and stability. A balanced approach recognizing both assets and liabilities is crucial for a complete picture of any individual's financial status. This awareness is fundamental to evaluating overall financial strength and risk tolerance.

3. Income Sources

The nature and consistency of income sources are critical determinants of an individual's net worth. A person's income directly fuels wealth accumulation. Reliable, substantial income streams provide the capital for investments, the ability to service debt, and the capacity to build savings. Varied and supplemental income sources offer resilience, and the ability to adapt to economic shifts. The correlation between income stability and overall net worth is undeniable. A sustained stream of high income directly contributes to a substantial net worth, while inconsistent or low income impedes net worth growth.

Analyzing income sources reveals crucial details about the individual's financial strategies and risk tolerance. For example, an individual primarily reliant on a single high-paying job exhibits a high degree of financial dependence. Fluctuation in that single income stream poses a substantial risk. Contrastingly, individuals with diversified income sources, such as multiple streams from investments, business ventures, or diverse employment opportunities, possess greater financial resilience. These diversified income sources reduce reliance on any single factor, making the individual more resistant to economic downturns. This diversification is often a critical element in building substantial and sustained wealth. Historical patterns of income growth, income stability, and adjustments to income sources demonstrate a trajectory that significantly affects net worth. Real-life examples abound: entrepreneurs with multiple ventures often exhibit higher net worths than individuals in stable but less diversified positions.

In conclusion, income sources are fundamental to understanding net worth. Reliable and diverse income streams facilitate wealth accumulation, and consistent income is demonstrably linked to net worth growth. Evaluating an individual's income sources reveals their financial strategies, risk profile, and adaptability to economic shifts. A deeper understanding of income sources allows for a more complete evaluation of their net worth and overall financial health. Analyzing both the consistency and diversification of an individual's income sources is essential for making informed judgments about their long-term financial well-being and the sustainable growth of their net worth.

4. Investment Strategies

Investment strategies play a pivotal role in determining an individual's net worth. The effectiveness of these strategies directly influences the growth and stability of accumulated wealth. Successful investment approaches generally yield higher returns, translating to a greater net worth. Conversely, poorly conceived or executed strategies can lead to losses and a decrease in net worth. The fundamental principle is that effective investment strategies facilitate wealth accumulation and preservation.

Different investment strategies cater to varied risk tolerances and financial goals. Strategies emphasizing high-growth potential, such as venture capital investments or high-risk stocks, often carry a higher risk of loss but potentially offer significant returns. Conversely, strategies prioritizing lower-risk investments, such as government bonds or certificates of deposit, are less volatile but typically yield more modest returns. An individual's choice of strategy often depends on factors including age, investment horizon, and desired level of risk. For instance, a younger investor with a longer investment horizon may be more comfortable with higher-risk strategies, while a more mature investor may lean toward more conservative approaches. Diverse portfolios often incorporate various strategies to balance risk and return. Successful portfolio management hinges on tailoring investment strategies to align with specific financial objectives and risk profiles.

Understanding the correlation between investment strategies and net worth is crucial for financial planning. It enables informed decision-making and allows for adjustments to strategies as circumstances change. Effective portfolio management demands continual review and adaptation of investment strategies. This constant evaluation helps maintain alignment with changing financial goals and market conditions. An investor with a clear understanding of their investment strategy's potential impact on their net worth is better positioned to make informed choices, potentially leading to sustainable wealth growth. Ultimately, the sophistication and success of investment strategies directly impact the trajectory and magnitude of an individual's net worth.

5. Valuation Methods

Determining an individual's net worth necessitates a thorough understanding of valuation methods. Accurate appraisal of assets is paramount; variations in methodology directly affect the calculated net worth figure. Different assets require distinct valuation approaches. Real estate, for example, often employs comparable sales analysis, considering recent transactions for similar properties in the area. Stocks typically rely on market prices, reflecting supply and demand dynamics. Complex assets, like private equity holdings or intellectual property, may require specialized valuation techniques, possibly involving discounted cash flow models or expert opinion.

The precision of valuation methods directly impacts the reliability of the calculated net worth. Inaccurate or inappropriate valuation can lead to a significantly skewed representation of financial standing. A property valued excessively high, for instance, inflates the net worth, potentially misleading investors or stakeholders. Conversely, undervalued assets could underrepresent true financial capacity. The selection of suitable valuation methods must consider the specific characteristics of each asset and the intended use of the net worth assessment. For example, a valuation for estate planning purposes might use different criteria than a valuation for a potential business acquisition.

The choice and application of valuation methods are crucial components in ensuring accurate net worth assessments. Consistency and transparency in the methods employed are vital for building trust and credibility. Proper documentation of the valuation methodology, supporting data, and expert rationale is essential for accountability and potential future reference. Challenges may arise from the inherent complexities of some assets, demanding specialized expertise. Nevertheless, meticulous adherence to established valuation principles ensures a robust and reliable estimation of net worth. Thoroughness, transparency, and appropriate methodology are essential to maintain the accuracy of net worth estimations and avoid potentially detrimental misinterpretations.

6. Public Perception

Public perception of an individual's financial standing, or "holyten networth" in this instance, significantly influences various aspects of their life and career. This perception, shaped by available information, media portrayal, and public discourse, can impact investment decisions, public image, and even social standing. Understanding this complex interplay is crucial for comprehending the broader context surrounding "holyten networth."

- Influence on Investment Decisions

Public perception of financial strength or vulnerability can directly affect investment opportunities. Favorable public perception might encourage investment and potentially raise asset values. Conversely, a perceived financial weakness can discourage investment and negatively impact asset valuation. Media reports and public discourse often contribute to this dynamic, affecting market trends. For example, if substantial doubts exist regarding an individual's financial stability, the market might react by reducing interest in their holdings, potentially lowering the overall valuation of their assets.

- Impact on Public Image and Reputation

Public perception of "holyten networth" can significantly influence an individual's public image and reputation. A perception of substantial wealth may attract positive attention but also potential criticism. Conversely, if the public perception is of financial vulnerability, it could attract unwanted scrutiny or suspicion. This aspect is particularly relevant in the media age, where public image is frequently scrutinized and shaped by public narrative and perception. For example, unfavorable reports about spending or debt could damage an individual's public image and reputation.

- Effect on Social Standing and Interactions

Public perception of "holyten networth" can significantly impact an individual's social standing and interpersonal interactions. In some societies, high net worth can lead to preferential treatment and increased social influence. However, public perception can also create social distance and cause certain interactions to be perceived through the lens of financial status. The implications on social standing depend heavily on cultural norms and individual values.

- Potential for Manipulation and Misrepresentation

Public perception of "holyten networth" is susceptible to manipulation and misrepresentation. Speculative reporting or intentional misinformation can significantly distort public opinion, thereby potentially impacting investment decisions and financial standing. In the context of an individual's financial well-being, accurate and verifiable information is crucial to fostering a balanced perspective. Reliable sources and transparency in financial reporting become vital under these circumstances.

In conclusion, public perception holds a multifaceted and powerful influence on the concept of "holyten networth." The interplay between financial standing, media portrayal, and public discourse contributes to shaping public opinion. Investors, individuals, and society as a whole should be aware of the potential for misinterpretation and manipulation when evaluating perceptions of an individual's wealth. Accurate and reliable data, coupled with responsible media reporting, can mitigate the impact of potential misrepresentations.

7. Market Trends

Market trends exert a significant influence on an individual's net worth, such as "holyten networth." Fluctuations in market conditions, encompassing factors like interest rates, inflation, and economic growth, directly affect asset values. For instance, a robust stock market often leads to increased investment returns, thereby boosting net worth. Conversely, a downturn in the market can result in losses and a corresponding decrease in net worth. The connection is not merely correlational; market trends often act as a catalyst, shaping investment strategies and influencing the trajectory of an individual's wealth.

The significance of market trends as a component of net worth cannot be overstated. A thorough understanding of prevailing market conditions enables informed investment decisions. For example, during periods of high inflation, individuals might favor investments with inflation-hedging capabilities, such as commodities or real estate. Conversely, a stable market with low inflation might encourage investment in dividend-paying stocks or other income-generating assets. Real-world examples abound: the dot-com bubble of the late 1990s showcased how speculative market trends can lead to substantial wealth accumulation (or loss), while the 2008 financial crisis underscored the devastating impact of negative market trends on individual net worth. The ability to anticipate and adapt to evolving market trends is a crucial element of successful wealth management.

In conclusion, market trends are an integral part of assessing and managing net worth. Understanding these trendsnot just the current state but also their potential trajectoryis essential for making sound financial decisions. Individuals and institutions must recognize the dynamic relationship between market conditions and their financial well-being. The connection between market trends and net worth emphasizes the necessity of constant vigilance, strategic adaptation, and a proactive approach to wealth management in the face of evolving market dynamics. The implications of ignoring or misinterpreting market trends can be substantial, potentially leading to significant financial losses or missed opportunities for growth.

8. Financial History

An individual's financial history provides crucial context for understanding their current net worth. It serves as a roadmap, revealing patterns of income generation, expenditure, investment behavior, and debt management. This historical record is not merely a collection of past events; it's a significant indicator of future financial potential and risk tolerance. A consistent history of prudent financial management often correlates with a higher and more stable net worth, while a history of irresponsible spending or poor investment choices might suggest vulnerabilities.

Analyzing financial history involves examining various facets, including income sources, saving habits, investment track records, and debt repayment patterns. Consistent savings and investment over extended periods often contribute to substantial wealth accumulation, while a history of excessive spending or accumulating debt suggests potential financial constraints. Furthermore, significant financial setbacks, such as job loss or unexpected expenses, can provide insights into resilience and ability to recover. The ability to weather financial storms is often a key factor in maintaining and growing net worth, and this resilience is visible in a robust financial history. Real-world examples abound: entrepreneurs who demonstrate a track record of managing various ventures with both successes and failures often build a substantial net worth from these experiences; similarly, a history of responsible budgeting and debt repayment often leads to a higher net worth and financial stability over time.

Understanding financial history's connection to net worth has practical implications for various situations, including investment decisions, loan applications, and estate planning. Lenders, for example, utilize an individual's financial history to assess creditworthiness and risk, factoring in past repayment patterns and debt management. Investors might analyze past investment performance and strategies to gauge risk tolerance and potential future returns. Estate planning often requires a thorough review of an individual's financial history to ensure assets are distributed equitably and sustainably. In essence, a complete understanding of financial history is a fundamental element for effectively evaluating and managing an individual's financial well-being, leading to more informed decisions and a clearer picture of the current and potential net worth.

Frequently Asked Questions about "Holyten Net Worth"

This section addresses common inquiries regarding the financial standing of Holyten, aiming to provide clarity and accurate information. Comprehensive analysis requires specific data, and this FAQ offers general guidance.

Question 1: What is "net worth," and how is it calculated?

Net worth represents an individual's financial position. It is calculated by subtracting total liabilities from total assets. Assets include all valuable possessions, such as real estate, investments, and personal property. Liabilities represent outstanding debts and obligations.

Question 2: Why is understanding "Holyten net worth" important?

Understanding net worth offers insights into financial health and stability. For businesses, it provides data on a potential partner's or client's financial strength. Public knowledge of an individual's wealth can influence market trends, investment decisions, and public perception.

Question 3: What specific data is needed to determine "Holyten net worth" accurately?

Precise calculation necessitates detailed information about Holyten's assets, liabilities, income streams, investment strategies, and historical financial performance. This comprehensive data is crucial for a precise assessment.

Question 4: How do market trends impact "Holyten net worth"?

Market fluctuations significantly affect net worth. Positive market trends usually lead to increased asset values, while negative trends can result in losses, directly impacting the overall financial position.

Question 5: How does public perception influence the perceived value of "Holyten net worth"?

Public perception, shaped by media reports, public discourse, and available information, influences the perceived value of "Holyten net worth." Misinformation or speculation can potentially distort this perception.

In summary, determining "Holyten net worth" requires careful analysis of various factors. Accurate valuation necessitates comprehensive data regarding assets, liabilities, and financial history. Market conditions and public perception play a significant role in shaping the overall understanding of this individual's financial standing.

Further research into specific details about Holyten's financial situation may be necessary for a complete and detailed understanding of this topic.

Conclusion

This analysis of "Holyten net worth" underscores the intricate interplay of various factors influencing an individual's financial standing. A precise estimation requires detailed information regarding assets, liabilities, income sources, investment strategies, and historical financial performance. Market trends and public perception significantly shape the perceived value and potential trajectory of this financial position. The accuracy of any valuation depends critically on the availability and reliability of this data.

Ultimately, understanding "Holyten net worth" necessitates a comprehensive, multifaceted approach. The factors discussedfrom asset valuation to market trendsall contribute to a complex picture of financial strength and stability. Without the crucial details outlined, any estimation remains speculative, emphasizing the importance of reliable and verifiable data for a meaningful evaluation of financial standing. Future analyses might benefit from a more specific focus on certain elements, like investment strategies, for a more detailed understanding of the dynamics at play.